Cannabis Regulators of Color Coalition Releases White Paper Critical of SAFE Banking Act

As the momentum for cannabis legalization grows, social equity continues to be a key issue for the industry and politics on both sides of the

As the momentum for cannabis legalization grows, social equity continues to be a key issue for the industry and politics on both sides of the

The House of Representatives recently passed a bill allowing banks to serve marijuana businesses without being punished for breaking federal law. Dubbed the “SAFE Banking

It may come as a surprise to many: cannabis business is still crippled by the federal government’s laws restricting banking rights. Since all banks must

April 1st brought upsetting news to the CBD market that was no April Fool’s joke. Elavon announced, effective immediately, they would no longer be accepting

Wells Fargo Bank Dumps Florida Candidate for Accepting Campaign Money from Cannabis Industry

Banking problems businesses face in the cannabis industry.

The amendment would have protected banks who are working with legal cannabis companies.

The California Senate passed SB 930, which seeks to allow the $10 billion legal cannabis industry to use banks.

The defeat of the Safe Banking Amendment was not a vote about marijuana, but about normalization.

After two years of happily servicing Illinois’ medical marijuana industry, the Bank of Springfield is closing its doors.

U.S. Treasury Secretary wants banks to open accounts for marijuana businesses so that the government can collect taxes.

The Bank of North Dakota is the only financial institution that is openly doing businesses with the cannabis industry.

The AG’s decision to rescind the Cole Memo has left banks and credit unions working with canna-businesses scrambling.

The guidelines are unclear, which may prompt financial institutions to start closing accounts with marijuana businesses.

Severn Bancorp in Annapolis has provided accounts for several customers in the cannabis industr.

If you ask any business owners involved in the cannabis industry what one of their biggest concerns is for our industry, you are likely to

Written by Derek Davis of California Cannabis CPA If you own or plan to own a cannabis business, it’s important to know that getting financial

A U.S. Senate committee voted today in support of opening up banking services to state-legal marijuana businesses. By a vote of 16-14, the Senate Appropriations

Passing the House of Representatives with a vote of 56-3, House Bill 4094, which seeks to remove the criminal liability from state law to allow

Fourth Corner Credit Union sued the Federal Reserve in an attempt to gain access to the federal banking system. That case was dismissed today. I

Marijuana businesses are largely boxed out of the banking industry. Most banks will not work with marijuana businesses because marijuana is illegal federally. Last year

Any owner of a marijuana business will tell you that a lack of banking options for the industry is a huge problem. For a very

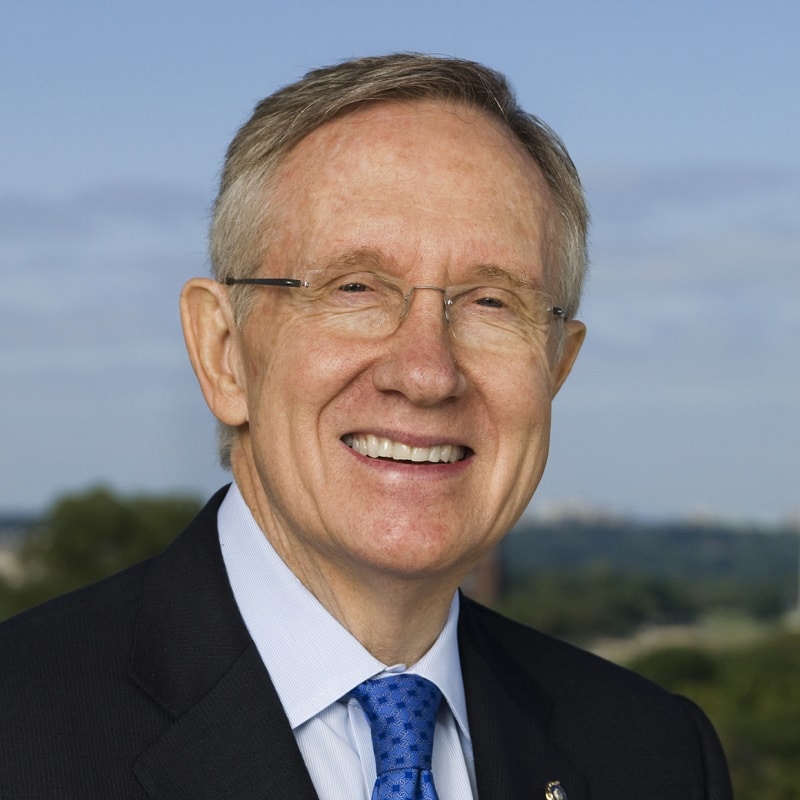

Senate Democratic Leader Harry Reid (D-NV) today signed on as a co-sponsor to the Marijuana Businesses Access to Banking Act of 2015 (S.1726), bipartisan legislation originally